Budgeting 101: Mastering the Basics

Budgeting is often misunderstood. For some, it sounds restrictive—like a list of things you can’t do or buy. For others, it’s something they know they should do, but never quite get around to. But the truth is simple: budgeting is freedom.

At its core, budgeting isn’t about saying “no” to everything you enjoy. It’s about understanding where your money goes, taking back control, and aligning your spending with your values and goals. Whether you’re trying to save more, get out of debt, or just stop feeling anxious every time you check your bank account—budgeting is the foundation.

This guide will take you step-by-step through the budgeting basics, starting with the two key building blocks of every financial plan: income and expenses. Once you truly understand these, you’ll see how small changes can lead to big results.

We’ll break down:

- How to identify and track your income sources

- How to categorize and manage your expenses

- What happens when income and expenses are out of balance—and how to fix it

By the end of this article, you’ll have a clear understanding of how to build a budget that works for you. Not just for today, but for your future.

What Is Money—Really?

Most people think of money as a physical thing: coins, bills, numbers in a bank account. But at its core, money is a system—a man-made construct designed to represent value, enable exchange, and track obligations.

But here’s the twist that few understand:

Every time new money is created, new debt is also created.

This is not just theory—it’s the foundation of our modern financial system, especially in countries with central banking and fiat currencies.

Money = Debt

When a central bank (like the Federal Reserve in the U.S., or Danmarks Nationalbank) “prints” money, it doesn’t just hand it out. It usually does so by lending it—to commercial banks, who then lend it to businesses and individuals. The money you borrow for a car, a house, or a credit card? It didn’t exist before. It was created at the moment you signed for it.

So every time money is created, a matching amount of debt is born. It’s a debt-based system.

That’s why governments, banks, and financial institutions want you to borrow—because debt fuels the economy. More borrowing means more spending, which drives growth. But it also keeps you in the system, paying interest, working harder, and never quite breaking free.

Here’s Where It Gets Dangerous

When you take out a loan, you receive both sides of the equation:

You get the money (the asset)

You also take on the debt (the liability)

If you spend that money wisely—on something that grows in value or earns you income—you’re using the system to your advantage. Examples:

✔ Investing in a business

✔ Buying property that appreciates

✔ Gaining education that increases your earning power

But if you spend that money on consumption—like designer clothes, a vacation, or a lifestyle upgrade—you’re left with nothing but the debt once the fun is over.

That’s when the system wins—and you lose.

The Trap: The Perpetual Debt Cycle

Many people fall into this loop:

- Borrow money

- Spend it on things that lose value

- Struggle to repay

- Borrow more to cover the gap

- Repeat

This merry-go-round drains your wealth, freedom, and energy. It’s why so many people feel stuck, even when they earn a decent salary.

Worse, because money itself is tied to debt, the system demands growth to survive. If everyone stopped borrowing tomorrow, the economy would slow dramatically. That’s why the system is built to encourage debt—even celebrate it.

Understanding Money = Power

When you really understand how money works, you start to make smarter choices:

- You borrow carefully, only when it creates value

- You avoid consumer debt like a virus

- You stop trying to impress people with things you can’t afford

- You build wealth on purpose—not by accident

You stop being used by the system, and you start learning how to use the system.

Money isn’t evil. Debt isn’t evil. But not understanding how they work? That’s dangerous.

Your Relationship with Money: Break the Cycle, Build the Foundation

Most people never really learn how to have a healthy relationship with money. It’s not taught in school, and many of us grow up watching the people around us struggle with it—living paycheck to paycheck, borrowing to get by, and hoping things somehow work out. But one of the most dangerous misunderstandings is how we view debt.

Too often, people treat loans as a normal part of life—without fully understanding the difference between good debt and bad debt. Taking a loan to invest in something solid—like education, a business, or property—can be a smart move, as long as the return outweighs the cost. But taking loans for consumption—like shopping, vacations, or a new phone—is a trap. You’re borrowing from your future self for something fleeting, and the cost is long-term stress, interest, and financial instability.

If you have consumer debt, your first step in budgeting—before saving, investing, or anything else—is simple: Get rid of it. No matter what.

This is step one, and it’s non-negotiable.

Debt doesn’t just drain your money—it drains your mental energy. It creates a false sense of security where you shuffle money from one account to another, hoping to plug holes in a sinking ship. Some people live in a cycle of moving funds from one credit card to another, delaying reality instead of dealing with it. That’s not a solution—it’s a merry-go-round of compounding interest, and every turn costs you more.

To break the cycle, you need to face it directly. Get honest about your total debt. Understand the interest rates. Stop borrowing. And start building a plan to pay it back—bit by bit, until you’re free. Only when you’ve cleared that weight can you begin to build real wealth.

Make a decission: Get Out Of Debt! This will teach you how to have an intimate and loving relationship with money.

The Benefits of Taking Control of Your Finances

When you start planning your money and truly knowing your numbers, something shifts. It’s more than just balancing a spreadsheet—it’s about taking responsibility for your life. And that decision changes everything.

Here are some of the powerful benefits:

You Feel on Top of Things

No more avoiding your bank app or stressing at the grocery store checkout. When you know what’s coming in, going out, and what’s possible—you move through life with confidence instead of anxiety.

You Develop Leadership Qualities

Taking control of your finances forces you to practice discipline, foresight, and responsibility—all key traits of a strong leader. When you lead your own life well, others notice. You naturally grow into someone who leads at home, at work, and in your community.

You Make Smarter Decisions

Once you understand how money flows through your life, your decision-making becomes sharper. You pause before impulse buys. You weigh opportunities more clearly. You start asking: “Does this support the life I want?”

You Create Stability for Your Family

When your finances are organized, your home becomes more peaceful. Fewer money fights. Less stress. More ability to plan, support your children, or surprise your partner with something thoughtful. This sense of control spreads to the people around you, giving them a sense of security and calm.

You Inspire Friends and Influence Others

Your clarity and confidence won’t go unnoticed. Friends will ask how you made progress. Colleagues may be inspired by your mindset. You may even help others take the first step toward managing their own finances—because you’ve become an example.

You Attract Better Circumstances

There’s something magnetic about someone who’s in control of their life. New job offers. Better relationships. Financial opportunities. When you act with clarity, responsibility, and purpose, you open doors you didn’t even know existed.

You Build Momentum

Success with money spills into other areas. You start eating better, moving more, setting goals, and believing in what’s possible. Why? Because you’ve proven to yourself that you can change your situation. That’s powerful energy.

In short, budgeting and financial planning isn’t just about money—it’s about becoming the person who owns their life. When you take that step, the benefits reach far beyond your bank account.

If you have debt: How to Structure a Debt Payoff Plan in Your Budget

Once you’ve identified that you have debt—especially high-interest consumer debt—your next mission is to build it into your budget as a priority, not an afterthought. This isn’t about shame. It’s about taking back control, one step at a time.

Here’s how to get started:

Step 1: List Every Debt You Owe

Open up a spreadsheet, notebook, or budgeting app, and record:

Who you owe (credit card, loan, etc.)

Total balance

Minimum monthly payment

Interest rate (APR)

This gives you a full, honest picture of your debt landscape—so you can build a strategy around it.

Step 2: Choose a Payoff Strategy

There are two popular (and proven) approaches. Choose the one that fits your mindset best:

The Avalanche Method (Mathematically Smart)

Focus on paying off the highest-interest debt first, while making minimum payments on the rest.

Once the highest-interest debt is gone, roll that payment into the next one.

Saves you the most money in the long run.

The Snowball Method (Psychologically Motivating)

Focus on the smallest debt first, regardless of interest rate.

As each balance is paid off, roll that amount into the next.

Builds momentum and emotional wins early.

Bonus tip: If you’re highly motivated by numbers and efficiency, go Avalanche. If you need quick wins to stay on track, go Snowball.

Step 3: Build Debt Payoff into Your Budget

Once you’ve chosen a method, plug it into your monthly budget:

- Cover all your essential expenses first.

- Make all minimum debt payments.

- Allocate all remaining surplus toward your target debt.

Even €50 or $100 extra per month can make a serious impact—especially when combined with discipline and time.

Let’s get started planning your budget!

If you want to take control of your finances, budgeting is the place to start. It’s not about restriction—it’s about clarity and choice. And at the core of any budget are two simple elements:

1. Income – What You Earn – only recurring income

Your income is the total amount of money you bring in. This can include:

- Salary or wages from a job

- Side hustles or freelance work

- Government benefits

- Investments or passive income

Knowing your exact monthly income gives you a clear foundation for what you can afford—and where you stand.

2. Expenses – What You Spend

Expenses are everything that takes money out of your pocket. These typically fall into two categories:

- Fixed expenses – Rent, mortgage, subscriptions, loan payments

- Variable expenses – Groceries, entertainment, dining out, transport

Tracking every expense, no matter how small, is key to understanding your spending habits.

The Golden Equation: Income vs. Expenses

Once you know both numbers, budgeting becomes simple:

Budgeting begins with awareness. When you clearly see what’s coming in and what’s going out, you’re no longer guessing—you’re in control. The simple act of comparing your income and expenses gives you valuable insight into your financial reality.

- If income > expenses: You have a surplus—money left over to save, invest, or spend intentionally.

- If expenses > income: You’re in a deficit—likely relying on debt or draining savings to get by. This leads to stress and long-term financial instability.

Once you lay it all out, you’ll end up with one of two scenarios:

✅ 1. A Positive Balance (Surplus)

If your income is greater than your expenses, you’re in a strong position. This surplus means you have money left over each month to save, invest, pay off debt faster, or put toward goals that matter to you. It’s the ideal scenario—and budgeting helps you protect and grow it.

⚠️ 2. A Negative Balance (Deficit)

If your expenses are greater than your income, it’s a red flag—but also an opportunity. A deficit means you’re likely relying on credit, dipping into savings, or falling behind financially. The good news? Your budget shows you exactly where the problem is, so you can take action—cut back, earn more, or both.

This means:

Budgeting begins with awareness. When you clearly see what’s coming in and going out, you’re in a position to make real, empowered decisions. Whether you’re building savings, paying off debt, or aiming for financial freedom—mastering this balance is step one.

Lay It All Out — Every Penny Counts

Before you can build a budget, you need to see the full picture. Not just guesses, not estimates—real numbers. This step is all about getting brutally honest with yourself by tracking every dollar flowing in and out of your life.

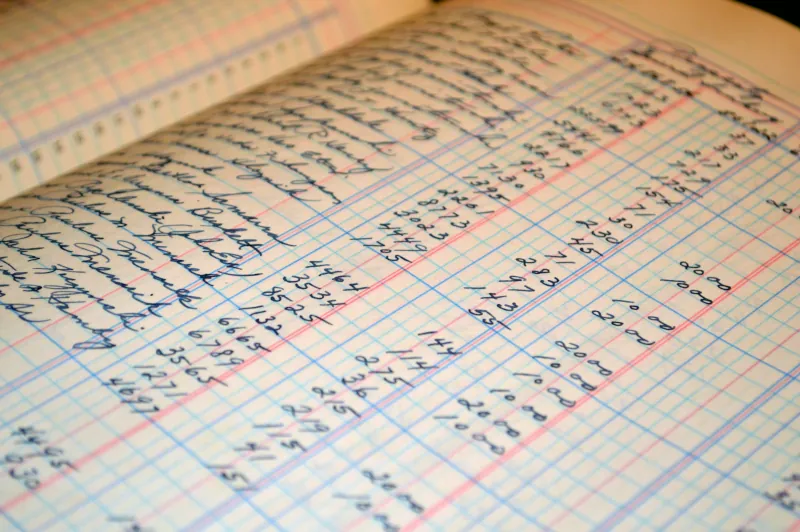

Whether you prefer a digital spreadsheet, a budgeting app, or good old-fashioned pen and paper, the goal is the same:

Create two columns:

1️⃣ Income

2️⃣ Expenses

Then categorize and list every single transaction that passes through your financial ecosystem. Like this:

Step 1: Start with Income – What You Bring In

Begin by identifying all sources of money coming into your life. Include net (after-tax) amounts so you’re working with spendable income.

Common income sources:

- Salary or wages (from all jobs)

- Side hustle or freelance work – but only if it is a regular income. Maybe you can calculate a monthly average.

- Government benefits or subsidies

- Investment returns (dividends, interest)

- Child support or alimony

- Rental income

- Any other consistent cash inflow

💡 Tip: Check the past 3 months of your bank statements or payslips to spot income you may forget, like refunds or irregular gigs.

Step 2: Track Expenses – Where the Money Goes

Now, move to the expenses column. This is where many people get surprised. You’ll want to go through at least the last 1–3 months of bank and credit card statements, and also review:

- Insurance policies

- Loan agreements

- Subscriptions

- Recurring bills

Categorize each expense to get clarity:

Fixed Expenses (same every month)

- Rent or mortgage

- Car payment

- Insurance (health, home, auto)

- Subscriptions (Netflix, gym, software)

Variable Expenses (fluctuate monthly)

- Groceries

- Dining out

- Gas/transportation

- Entertainment

- Personal care

- Clothing

- Gifts

- Pet expenses

Irregular or Annual Expenses

- Car registration

- Annual subscriptions

- Holiday spending

- Emergency repairs

- Medical bills

Pro tip: Divide annual expenses by 12 to get a monthly average or 6 if it is a half year expense. You don’t want to be surprised later.

Step 3: What are the net result – Positive or negative?

How to Assess the Result of the Spreadsheet

- Find the Net Result:

✅ Usually, this is: Net Result=Total Income – Total Expenses

- Identify Whether It’s:

✅ Positive (Surplus): You’re earning more than you’re spending.

❌ Negative (Deficit): You’re spending more than you’re earning.

Step 4: What to Do in BOTH Cases – Optimization Tips

If the Result Is Positive (Surplus):

Goal: Maximize the efficiency of your extra funds.

Tips:

- Automate Savings:

- Set up automatic transfers to a savings or investment account.

- Use the 50/30/20 rule (50% needs, 30% wants, 20% savings/debt reduction) or adjust as needed.

- Invest Strategically:

- Consider stocks, ETFs, mutual funds, or retirement accounts (e.g., pension, IRA).

- Diversify to reduce risk.

- Pay Down Debt Faster:

- Apply surplus to high-interest debt (credit cards, loans) to save on interest.

- Build or Boost Emergency Fund:

- Target 3–6 months of living expenses.

- Reinvest in Yourself:

- Courses, certifications, health, tools that improve future income.

- Optimize Tax Strategy:

- Use tax-efficient accounts and deductions.

- Review Subscriptions/Expenses Anyway:

- Even with a surplus, trim low-value recurring costs.

If the Result Is Negative (Deficit):

Goal: Close the gap and regain financial balance.

Tips:

Increase Income:

- Side Hustles: Freelance, gig work, tutoring, etc.

- Sell Unused Items: Marketplace, secondhand apps.

- Ask for a Raise or Look for Better-Paying Jobs.

- Monetize Skills or Hobbies (e.g. design, writing, crafts).

Cut Expenses:

- Track & Categorize Spending: Use tools like Mint, YNAB, Excel.

- Eliminate Non-Essentials: Subscriptions, takeout, impulse buys.

- Negotiate Bills: Call to reduce internet, phone, insurance rates.

- Switch to Cheaper Alternatives: Generic brands, energy-efficient solutions.

Use a Budgeting Strategy:

- Zero-based budgeting: Assign every dollar a job.

- Envelope method: Visual control of spending categories.

Debt Optimization:

- Debt Snowball: Pay off smallest debts first for momentum.

- Debt Avalanche: Pay off highest-interest debts first for savings.

If Everything Else Fails: Get Help

If you’ve done all you can — tried to get a raise, worked extra hours, cut every possible expense — and you still can’t make ends meet, don’t give up. You’re not alone, and there are still meaningful steps you can take.

1. Look Online for Support & Resources

- Search for free financial advice, budgeting tools, and community forums.

- Use tools like ChatGPT to ask questions — anything from debt strategies to daily budgeting tips. Sometimes just reframing your plan makes a huge difference.

2. Talk to Someone You Trust

Involve a friend, partner, or family member.

A second set of eyes — even if they’re not “finance-savvy” — can offer:

- A new perspective

- Emotional support

- Accountability

- Creative solutions you may not have seen

3. Reach Out to Professional Help (Free or Low-Cost)

- Non-profit financial counseling services exist in many countries.

Examples: NFCC (US), StepChange (UK), Debt Advisory Centres. - Many banks or unions offer free consultations.

- Some workplaces provide Employee Assistance Programs (EAPs) with financial coaching.

4. Check for Government or Community Support

You might be eligible for:

- Housing or utility assistance

- Food programs (e.g. food banks, SNAP)

- Childcare subsidies

- Tax credits or relief programs

It’s not failure to ask — it’s smart resourcefulness.

5. Take Care of Your Mental Health

- Financial stress is real and can cloud judgment.

- Don’t isolate yourself — talk to someone.

- Consider mindfulness apps or journaling to clear your head while you rebuild control.

Bonus: Do This Every Month

- Reassess your spreadsheet monthly.

- Track trends (are you improving or worsening?).

- Set specific monthly goals (e.g., “Cut food expenses by 15% or what ever you need”).

Download your budget templates here:

You Can Do This!

No matter where you’re starting from—whether you’re deep in debt, living paycheck to paycheck, or just beginning to take your finances seriously—you have the power to change your future. It starts with awareness, builds through discipline, and grows with every smart decision you make. You don’t need to be perfect. You just need to start.

Remember: you’re not stuck. You’re learning. You’re growing. And every step you take puts you back in control. Keep going, stay consistent, and don’t let fear or past mistakes define your future.

You’ve got this.

Good luck—and welcome to the first day of the rest of your financial successful life.